Start your day with intelligence. Get The OODA Daily Pulse.

Start your day with intelligence. Get The OODA Daily Pulse.

ISS-Corporate, a Maryland-based company that offers corporate structure solutions for everything from executive compensation to cyber risk programs, has a compelling thought leadership library. We stumbled upon it through a post from Subodh Mishra, Global Head of Communications at ISS STOXX, on The Harvard Law School Forum on Corporate Governance entitled AI Governance Appears on Corporate Radar. Mishra’s summary post is based on an ISS-Corporate memorandum – AI and Board Of Directors Oversight: AI Governance Appears on Corporate Radar – authored by Veronica Nikitas, a robust quantitative framing of the core issues surrounding this topic. In this post, you will find the key takeaways and excerpts from the report and a forward-thinking conclusion by the author.

As AI becomes a material factor for many companies, investors may demand that companies disclose relevant board skills and oversight responsibilities and enhance disclosure on AI.

Introduction

Board Oversight of AI

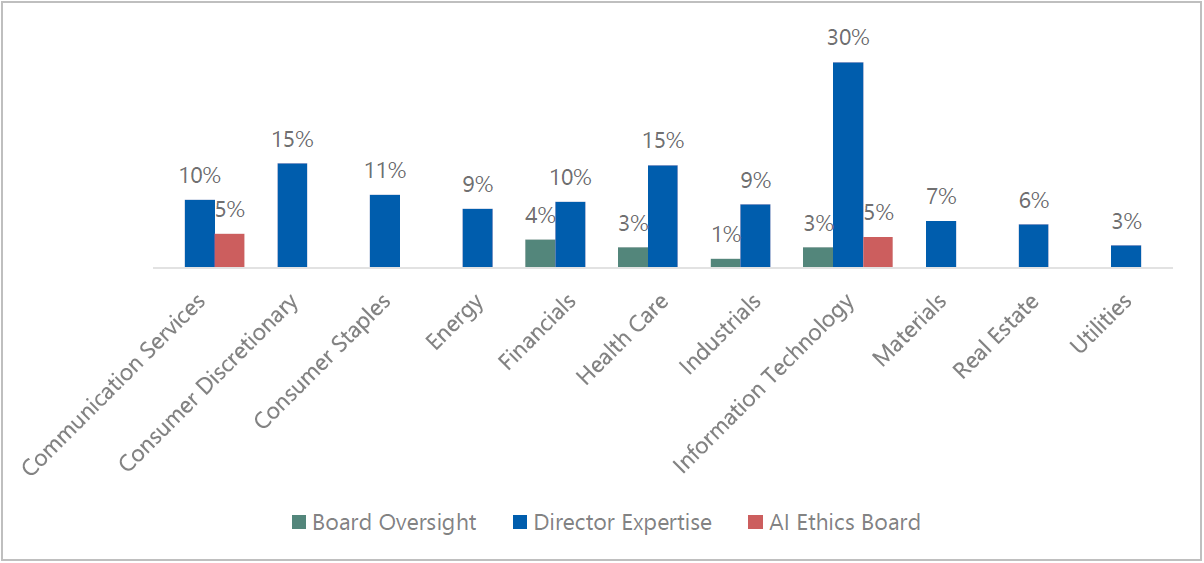

“…over 15% of the S&P 500 disclosed board oversight of AI, including specific committee oversight responsibility, director(s) with AI expertise, and/or an AI ethics board…”

The assessment process did not include references to AI in business strategy or executive officer expertise.

NOTE: In our OODA Loop editorial review of the report, while leadership in board-level AI governance by the IT sector was not surprising, consistent with the way the healthcare sector is the tip of the spear in AI innovation and early adopter implementation of AI solutions (as well as unfortunately, a prime target in the current ransomware scourge) we were not surprised to see that the report also identified the sector as an early adopter in AI governance and disclosure efforts.

Source: ISS-Corporate Analysis

Given the business functions of these four sectors (i.e., Information Technology, Health Care, Communication Services, and Consumer Discretionary), explicit disclosure of oversight responsibilities may become more prevalent in the coming years as AI gains adoption.

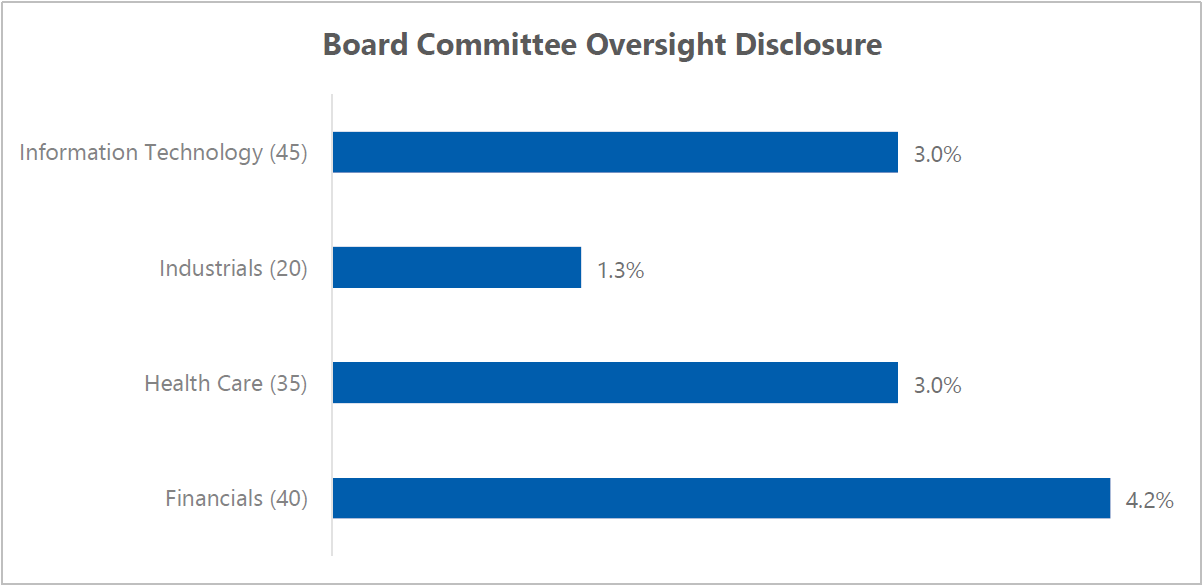

Committee or Full Board Oversight

Source: ISS-Corporate Analysis

Among S&P 500 companies that disclose full board or specific committee-level oversight of AI, companies in the Financials sector show the highest prevalence at 4.2%. These companies describe AI oversight responsibility as falling under the full board and a specific committee such as audit technology.

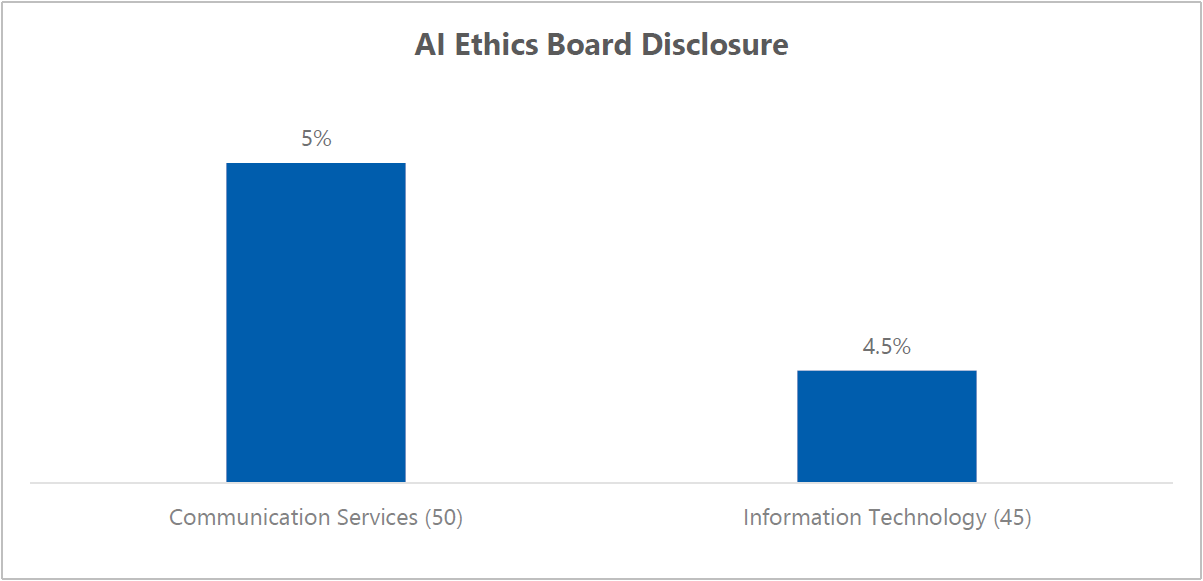

AI Ethics and Review Board

Source: ISS-Corporate Analysis

To download the full memorandum, go to AI and Board Of Directors Oversight: AI Governance Appears on Corporate Radar

Kudos to ISS Corporate and the author for this accessible, actionable report. Nikitas concludes the report with the following insights:

Your organization should be able to incorporate and compare its own Board of Directors AI governance and disclosure efforts and metrics into the framing of this report – and move forward based on insights garnered through such an internal exercise.

Corporate Board Accountability for Cyber Risks: With a combination of market forces, regulatory changes, and strategic shifts, corporate boards and directors are now accountable for cyber risks in their firms. See: Corporate Directors and Risk

Geopolitical-Cyber Risk Nexus: The interconnectivity brought by the Internet has caused regional issues that affect global cyberspace. Every significant event has cyber implications, so leaders must recognize and act upon the symbiosis between geopolitical and cyber risks. See The Cyber Threat

Ransomware’s Rapid Evolution: Ransomware technology and its associated criminal business models have seen significant advancements. This has culminated in a heightened threat level, resembling a pandemic’s reach and impact. Yet, there are strategies available for threat mitigation. See: Ransomware, and update.

Challenges in Cyber “Net Assessment”: While leaders have long tried to gauge both cyber risk and security, actionable metrics remain elusive. Current metrics mainly determine if a system can be compromised without guaranteeing its invulnerability. It’s imperative not just to develop action plans against risks but to contextualize the state of cybersecurity concerning cyber threats. Despite its importance, achieving a reliable net assessment is increasingly challenging due to the pervasive nature of modern technology. See: Cyber Threat

Decision Intelligence for Optimal Choices: Numerous disruptions complicate situational awareness and can inhibit effective decision-making. Every enterprise should evaluate its data collection methods, assessment, and decision-making processes – for more insights: Decision Intelligence.

Proactive Mitigation of Cyber Threats: The relentless nature of cyber adversaries, whether they are criminals or nation-states, necessitates proactive measures. It’s crucial to remember that cybersecurity isn’t solely the IT department’s or the CISO’s responsibility – it’s a collective effort involving the entire leadership. Relying solely on governmental actions isn’t advised, given its inconsistent approach toward aiding industries in risk reduction. See: Cyber Defenses

The Necessity of Continuous Vigilance in Cybersecurity: The consistent warnings from the FBI and CISA concerning cybersecurity signal potential large-scale threats. Cybersecurity demands 24/7 attention, even on holidays. Ensuring team endurance and preventing burnout by allocating rest periods are imperative. See: Continuous Vigilance

Embracing Corporate Intelligence and Scenario Planning in an Uncertain Age: Apart from traditional competitive challenges, businesses also confront unpredictable external threats. This environment amplifies the significance of Scenario Planning. It enables leaders to envision varied futures, thereby identifying potential risks and opportunities. Regardless of their size, all organizations should allocate time to refine their understanding of the current risk landscape and adapt their strategies. See: Scenario Planning

Track Technology-Driven Disruption: Businesses should examine technological drivers and future customer demands. A multidisciplinary knowledge of tech domains is essential for effective foresight. See Disruptive and Exponential Technologies.

Planning for a Continuous Pandemic Landscape: COVID-19’s geopolitical repercussions are evident, with recent assessments pointing to China’s role in its spread. Regardless of the exact origins, the conditions that allowed COVID-19 to become a pandemic persist today. Therefore, businesses must be prepared for consistent health disruptions, implying that a substantial portion of the workforce might always operate remotely, even though face-to-face interactions remain vital for critical decisions. See: COVID Sensemaking

The Inevitable Acceleration of Reshoring and its Challenges: The momentum towards reshoring, nearshoring, and friendshoring signals a global shift towards regional self-reliance. Each region will emphasize local manufacturing, food production, energy generation, defense, and automation. Reshoring is a complex process, with numerous examples of failures stemming from underestimating intricacies. Comprehensive analyses encompassing various facets, from engineering to finance, are essential for successful reshoring endeavors. See: Opportunities for Advantage