Start your day with intelligence. Get The OODA Daily Pulse.

Start your day with intelligence. Get The OODA Daily Pulse.

In two recent posts, we embarked on an effort to quantify crypto and digital assets enforcement and regulatory impacts and outcomes as they emerge in 2023:

We are also on the lookout for stakeholders and new organizations with enforcement and regulatory mandates. So far, we have surfaced the following organizations for your decision intelligence and risk awareness efforts:

This research effort is an extension of topics discussed in the “The Year Past and Looking into the Future” conversation at the December 2022 OODA Network Member Meeting. In this post, we turn to the recent headlines about and the organizational behavior of the Securities and Exchanges Commission (SEC), namely the SEC’s Division of Enforcement’s Crypto Assets and Cyber Unit.

In May, the SEC’s office for protecting investors in cryptocurrencies and other digital assets has been expanded and rebranded. Previously known as The Cyber Unit, it is now the Crypto Assets and Cyber Unit, with 20 new positions – including investigative staff attorneys, trial counsels, and fraud analysts, the SEC said in a news release: “By nearly doubling the size of this key unit, the SEC will be better equipped to police wrongdoing in the crypto markets while continuing to identify disclosure and controls issues with respect to cybersecurity,” (1)

According to The Record: ” The SEC created the unit in 2017, and since then the variety of digital assets available to investors has expanded greatly beyond just cryptocurrencies like bitcoin. The agency said the expanded unit will be better equipped to enforce securities laws as they relate to products such as decentralized finance (DeFi) platforms, non-fungible tokens (NFTs), and stablecoins that are pegged to traditional currencies like the U.S. dollar. The unit, which is part of the SEC’s Division of Enforcement, has brought more ‘more than 80 enforcement actions related to fraudulent and unregistered crypto asset offerings and platforms, resulting in monetary relief totaling more than $2 billion,’ the SEC said. Last week alone, the agency announced the prosecution of two separate cases. Last year Gensler called cryptocurrency markets ‘the Wild West’ of the finance world. In addition to policing digital assets, the Crypto Assets and Cyber Unit also can bring cases against public companies for failing to properly maintain cybersecurity controls and disclose security incidents. Gensler has led an effort for the SEC to create new rules for incident disclosures by public companies.'” (2)

Richard Gardner at The Daily Hodl captures concerns we share regarding overregulation – and expands his concerns to those of the China threat and privacy, concerns we also share. Although Gardner’s framing is not necessarily the tack we have taken in our analysis of these issues to date, his fusion of the threat vectors is interesting:

“While securing the marketplace is a laudable goal and one that is required for furthering mainstream investment there is a risk looming around the corner. As central banks begin to consider launching their own Central Bank Digital Currencies (CBDCs), there is a real risk of regulating bodies taking an authoritarian approach. If you look at the CBDC rollout in China, it should be a rude awakening that with the wrong regulations in place, financial privacy could well be significantly diminished. With the SEC enhancing its enforcement, what’s positive in terms of cybersecurity could turn into concern if the government takes the wrong tack on privacy rights.”

Gardner brings his argument in for a landing that is more in alignment with our primary concern – that of overregulation stifling innovation of the crypto ecosystem:

“The industry needs investors to have faith in the market. We do need to dedicate more resources to protect them. We do need to be better at policing wrongdoing in crypto markets and we certainly need a better handle on ensuring that exchanges are utilizing a quality technology apparatus to enhance cybersecurity. All of those things enhance the long-term viability of the digital assets space. That said, we must remain vigilant about investor privacy rights. A CBDC with authoritarian leanings is no replacement for cash, and the citizenry won’t stand for it. It is time for the government to come together with the industry to develop an approach that keeps the citizenry safe from bad actors while preserving privacy and continuing to allow crypto-preneurs to do what they do best innovate.” (3)

The SEC detailed that the “expanded Crypto Assets and Cyber Unit will leverage the agency’s expertise to ensure investors are protected in the crypto markets, with a focus on investigating securities law violations related to:

In April of 2022, SEC Chair Gary Gensler noted that “stablecoins in particular ‘raise three important sets of policy issues’ warranting further scrutiny by the SEC:

(1) ‘public policy considerations around financial stability and monetary policy’;

(2) ‘issues on how they potentially can be used for illicit activity’; and

(3) ‘issues for investor protection.’

When describing the third policy consideration, Gensler expressed concern that ‘the three largest stablecoins were created by trading or lending platforms themselves,’ which, in his view, poses ‘conflicts of interest and market integrity questions that would benefit from more oversight.’

The agency’s focus on crypto can be expected to intensify even further in the wake of the May 2022 meltdown of the cryptocurrency stablecoin TerraUSD and its sister token, Luna—an event that wiped out nearly the entire $40 billion market capitalization of Luna and accelerated the loss of $500 billion of value in the cryptocurrency economy. Unsurprisingly, Gensler and his colleagues have doubled down on their aggressive rhetoric since the Luna and TerraUSD crash. Speaking at a Financial Industry Regulatory Authority (FINRA) conference in Washington, D.C. on May 16, 2022, Gensler characterized cryptocurrency as a ‘highly speculative asset class,’ given what he perceives as its lack of transparency in the marketplace, and advocated for basic investor protections against front-running customers, manipulation, and fraud. Just a few days before those remarks, SEC Commissioner Hester Peirce (despite her vocal and repeated criticism of what she perceives as the SEC’s excessive regulation of the industry) hinted that ‘one place we might see some movement’ with regards to tougher regulations ‘is around stablecoins.’

These remarks have coincided with a broader effort by the SEC to expand its enforcement activity beyond issuance of crypto assets. In February of this year, for example, Enforcement brought its first action against a crypto lending platform, obtaining $100 million in penalties against BlockFi Lending LLC for its allegedly unregistered offering and sale of retail crypto lending products. In May, the SEC brought a settled action against NVIDIA Corporation for NVIDIA’s alleged failure to disclose that crypto mining was a significant element of its material revenue growth from the sale of its graphics processing units designed and marketed for gaming, with the company agreeing to a $5.5 million penalty. More recently, the SEC has reportedly been conducting an inquiry into safeguards against insider trading at one or more major crypto exchanges.” (4)

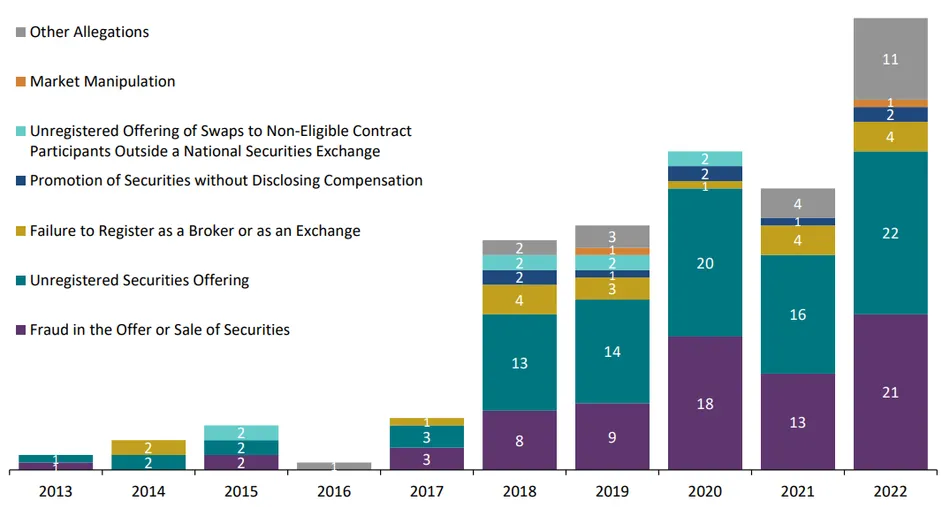

According to a 2022 report by Cornerstone Research and as reported by Decrypt: “Nearly half of SEC crypto enforcement actions in 2022 Were against ICOs [Initial Coin Offerings]. In 2022, the SEC brought a total of 30 cryptocurrency-related enforcement actions…Of the 30 enforcement actions, 14 involved initial coin offerings (ICOs), with 57% of these actions including a fraud allegation.

Image Source: Decrypt

We conclude our analysis through the lenses of national security risk – with a formative comparison to the regulatory environment (or lack thereof) in China – signified by recent developments in the Chinese crypto market:

Stay tuned, as the direction in which China is heading provides an extreme enforcement and regulatory contrast to that of the crypto market in the U.S., – eerily resembling an inversion of the extreme contrast of the U.S. Covid response to that of China’s “Zero Covid” policy. Interesting. Our research frameworks signal to us that there will be equally as many peaks and valleys and unintended consequences of this year-over-year, side-by-side crypto market comparison in 2023 as that of the global Covid response.

Of course, these recent developments are against a “big picture” background of the markedly different policy approach by China to the global ascendance of bitcoin, cryptocurrency, and CBDC which we first reported back in March in our Global Crypto and Digital Currency Initiatives Series post on China: “Market and governmental activities around digital asset growth, innovation, and legitimacy have been much more of a troubling mixed bag in China. What sets China apart from other parts of the world in its current relationship with digital assets and digital currency is the market development and technological innovation is showing clear signs of fusing with the surveillance state “build-out” that China has achieved in the last 5 to 10 years. Worse yet, the surveillance state technology ‘stack’ that is being perfected by China is also an export, which over time may include blockchain technologies as a dystopian platform for surveillance techniques. Overall, The Chinese centralized state has sent clear signals of an innate aversion to the decentralization and empowerment represented by bitcoin, blockchain, and cryptocurrency.”

We have four tracks on which we are curating and synthesizing information streams on the topics of crypto assets, cybersecurity, and national security risk:

Various perspectives on “crypto’s threat to national security” have also been voiced by the DOJ crypto chief, the CEO of Coinbase (‘crypto is up there with chips and 5G as a matter of ‘national security‘), and the Chair of the Commodities Futures Trading Commission (CFTC). And DARPA, of course, is on the scene with research efforts we took a look at back in November. We will synthesize these perspectives relative to Matt’s initial concerns in the weeks and months ahead. We are also tracking the recent crypto bankruptcies and the FTX saga – with its ongoing investigations, criminal indictments, and trials at the state, federal and civil levels – including the bipartisan bill that aims to prevent money laundering via cryptocurrency companies (amongst other U.S. Crypto, Digital Assets and National Security Policy endeavors).

https://oodaloop.com/archive/2022/04/14/web3-cyber-incident-database/

https://oodaloop.com/archive/2023/01/10/with-coinbase-investigation-and-100m-settlement-new-york-is-the-tip-of-the-crypto-regulatory-spear/