Start your day with intelligence. Get The OODA Daily Pulse.

Start your day with intelligence. Get The OODA Daily Pulse.

A strategic partnership was announced today between Ford and semiconductor manufacturer GlobalFoundries Inc (GF), which “opens the door” in the short term for more chips to be produced for Ford by the industry-leading semiconductor foundry.

According to a joint press release, the partnership also commits to “joint research and development to address the growing demand for feature-rich chips to support the automotive industry. These could include semiconductor solutions for advanced driver-assistance systems (ADAS), battery management systems, and in-vehicle networking for an automated, connected and electrified future. GF and Ford also will explore expanded semiconductor manufacturing opportunities to support the automotive industry. The announcement is consistent with both companies’ commitment to build innovative business relationships to regain supply-demand balance for chips in the auto industry as well as efforts to further accelerate technology innovation for the U.S. auto industry.”

This partnership comes at a time when there seems to be no end in sight for the current chip shortages, according to Brandon Kulik, head of Deloitte’s semiconductor industry practice: “The shortages are going to continue indefinitely. Maybe that doesn’t mean 10 years, but certainly we’re not talking about quarters. We’re talking about years.” Kulik’s perspective is a revision of the initial conventional wisdom within the industry, predicting a short-lived chip supply chain disruption. The industry is now mostly in agreement with Kulik’s assessment.

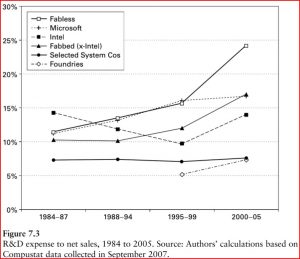

GlobalFoundries was born at a time when the semiconductor industry was in a crisis, attempting to reconcile the risk represented by the cost of internal R&D for innovative process development (i.e., next-generation chip design) and the exorbitant cost of building, owning, and operating fabrication plants. Chip companies were struggling to link these expensive value creation activities with value capture (i.e. low returns on investment after high-risk capital expenditures).

The “Low Returns, High-Risk Crisis” of the Semiconductor Industry

(Source: Chips and Change: How Crisis Reshapes the Semiconductor Industry, MIT Press. 2009)

In 2008, Advanced Micro Devices (AMD) spun off its entire chip manufacturing operation to an Abu Dhabi-based investment fund, which according to ZDNet at the time of the deal, committed to “invest $6 billion to finance a new factory near Albany, NY and to upgrade an existing plant in Germany.” AMD would own 44 percent of the joint venture, which became GlobalFoundries.

This move by AMD came at a time when companies like Texas Instruments (TI) were moving away from internal process development to attempt to keep up in-house with Moore’s Law and started working with foundries, part of an industry-wide response which included alliances (like AMD and the Abu-Dhabi-based investment fund) and consortia for cost-sharing. Back in 2009, reports put the cost estimate for the development of the 0.065-micron generation of semiconductors by one firm at $1.5B. (1)

According to Ars Technica, in 2021 “leading-edge fabs cost around $5 billion–$10 billion, multiple times what they cost a decade or two ago. As manufacturing techniques have advanced, the buildings themselves get more costly to construct, and the machines that make the chips have grown more expensive. The latest tools use extreme ultraviolet lithography, which is required to produce chips with features smaller than 7 nm, and they sell for upward of $120 million.”

Ironically, it is the outsourcing of chip manufacturing (first to Japan in the ’80s, the activities described above in the 2000s, and the current wave in Asia, specifically Tawain) which this Ford/GlobalFoundries strategic partnership is now designed to reverse.

In 2021, GlobalFoundries has approximately 15,000 employees and 200 global customers. The company is headquartered in Malta, NY (at the site of their inaugural foundry built in collaboration with AMD), with manufacturing facilities on three continents with locations producing a variety of chip form factors, including Burlington, Vermont (350–90nm; 200mm); Dresden, Germany (55–22nm; 300mm); East Fishkill, New York (180–14nm; 300mm), Malta, New York (14–12nm; 300mm), Singapore (130-40nm; 300mm and 500-40nm; 200mm). (2)

https://oodaloop.com/briefs/2021/07/21/ford-and-argo-ai-to-launch-self-driving-cars-with-lyft-by-the-end-of-the-year/

This partnership is now part of a strong portfolio of ongoing, bold strategic moves by Ford, including ending production in India and taking a $2 billion hit in the process; setting up a new EV battery center in southeast Michigan; investing $11 billion with South Korea-based energy company SK Innovations in new electric vehicle manufacturing plants (which will be built in Kentucky and Tennessee and is the largest manufacturing investment ever by the company); partnering with Argo AI to launch self-driving cars with Lyft by the end of the year (see above): and the “hotly anticipated battery-electric version of Ford’s bestselling vehicle,” the F-150 Lightning (available in 2022).

The value of the collaborative research projects, university collaborations, and government subsided labs, offspring of the same industry climate which gave birth to GlobalFoundries in the late 1990s, was best captured by the MIT Technology Review in a 2011 article about Sematech: “The consortium that helped revitalize the U.S. semiconductor industry in the 1980s and 1990s has become a model for how industry and government can work together.”

Be on the lookout for a resurgence of just this type of collaboration model in the coming months and years – along with more strategic activity like that of Ford and GlobalFoundries by other players in the industry – and the USG.

For more on the USG Strategic Framework for Semiconductor Manufacturing and Supply Chain Resiliency, including the CHIPs Act, see Building Resilient Supply Chains and Semiconductor Manufacturing

For more on China’s strategic framework and implementation measures for competitive advantage in the semiconductor industry, see China’s Formal Bid for Global Dominance of the Semiconductor Supply Chain

This page serves as a dynamic resource for OODA Network members looking for Global Supply Chain information to drive their decision-making process, grouped into the following categories: Pandemic Disruptions; Technology, Platforms, and Supply Chain Intelligence; Case Study: The Global Semiconductors Supply Chain; Supply Chains and Forced Labor; and National Security and Critical Infrastructure. See: Global Supply Chain Sensemaking

Now more than ever, organizations need to apply rigorous thought to business risks and opportunities. In doing so it is useful to understand the concepts embodied in the terms Black Swan and Gray Rhino. See: Potential Future Opportunities, Risks and Mitigation Strategies in the Age of Continuous Crisis

The OODA leadership and analysts have decades of experience in understanding and mitigating cybersecurity threats and apply this real world practitioner knowledge in our research and reporting. This page on the site is a repository of the best of our actionable research as well as a news stream of our daily reporting on cybersecurity threats and mitigation measures. See: Cybersecurity Sensemaking

OODA’s leadership and analysts have decades of direct experience helping organizations improve their ability to make sense of their current environment and assess the best courses of action for success going forward. This includes helping establish competitive intelligence and corporate intelligence capabilities. Our special series on the Intelligent Enterprise highlights research and reports that can accelerate any organization along their journey to optimized intelligence. See: Corporate Sensemaking

This page serves as a dynamic resource for OODA Network members looking for Artificial Intelligence information to drive their decision-making process. This includes a special guide for executives seeking to make the most of AI in their enterprise. See: Artificial Intelligence Sensemaking

From the very beginning of the pandemic we have focused on research on what may come next and what to do about it today. This section of the site captures the best of our reporting plus daily daily intelligence as well as pointers to reputable information from other sites. See: OODA COVID-19 Sensemaking Page.

A dynamic resource for OODA Network members looking for insights into the current and future developments in Space, including a special executive’s guide to space. See: Space Sensemaking

OODA is one of the few independent research sources with experience in due diligence on quantum computing and quantum security companies and capabilities. Our practitioner’s lens on insights ensures our research is grounded in reality. See: Quantum Computing Sensemaking.

In 2020, we launched the OODAcast video and podcast series designed to provide you with insightful analysis and intelligence to inform your decision making process. We do this through a series of expert interviews and topical videos highlighting global technologies such as cybersecurity, AI, quantum computing along with discussions on global risk and opportunity issues. See: The OODAcast