Start your day with intelligence. Get The OODA Daily Pulse.

Start your day with intelligence. Get The OODA Daily Pulse.

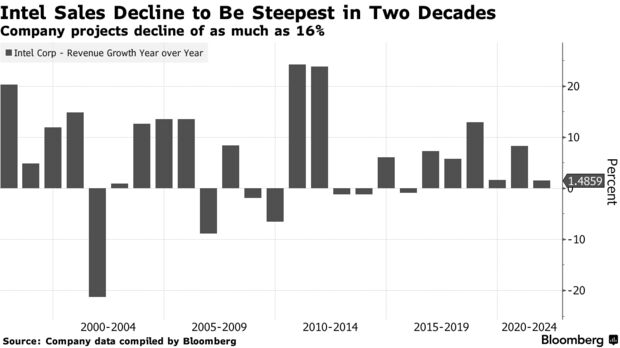

As we race towards the end of the 2022 calendar year, the following is a Q422 tracking and sensemaking post organized as a case study of Intel Corp., informed by the 2021 OODA Loop Stratigame – Scenario Planning for Global Computer Chip Supply Chain Disruption – and OODA Loop tracking, research, and analysis of the implementation phase of the recently passed Chips and Science Act of 2022.

Source: Bloomberg Technology

Intel CEO Pat Gelsinger made the rounds in October to “discuss earnings and guidance reactions, inventory and demand positioning, as well as the conversation around layoffs and cost adjustments.” (1)

“Intel Corp. shares climbed in late trading after the chipmaker pledged to slash costs, an effort to weather a persistent slump in computer demand that is dragging down sales and profit and obstructing its turnaround efforts. The company said actions including headcount reductions and slower spending on new plants will result in savings of $3 billion next year, with annual cuts swelling to as much as $10 billion by the end of 2025. Third-quarter profit and revenue tumbled, Intel said Thursday in a statement, and it again scaled back 2022 revenue and profit targets.

Chief Executive Officer Pat Gelsinger had been banking on a rapid rebound in semiconductor sales to help fund his ambitious plans to restore Intel to its former dominance in the $580 billion industry. Gelsinger, who predicted three months ago that the third quarter would be the nadir for the company’s performance, instead said that demand for Intel’s computer processors has fallen off even more sharply than projected and the outlook remains dour. ‘The worsening macro was the story and is the story,’ Gelsinger said in an interview. ‘There’s no good economic news.’ Predicting a bottom for the market for computer chips currently would be “too presumptive,” he said.

Source: Bloomberg News

Earlier this month, Bloomberg News reported that Intel was planning a major reduction in headcount, likely numbering in the thousands, according to people with knowledge of the situation. Some divisions, including Intel’s sales and marketing group, could see cuts affecting about 20% of staff, according to the people. In its earnings report Thursday, the company didn’t specify how many jobs would be eliminated.

Gelsinger said that level of profitability isn’t good enough and is partially a result of inefficiencies in Intel’s operations that need to be addressed. The company’s plants, once the industry leader, will be forced to report their utilization rates, and chip designers will have to improve at getting the blueprints they send to those facilities right the first time. Intel’s rivals use fewer people to get better results, he said.

Third-quarter sales for Intel’s data-center division — which typically contributes an outsized portion of profit –- dropped 27% to $4.2 billion, lower than the average analyst estimate of $4.83 billion. Client computing, Intel’s PC-chip unit, reported a sales decline of 17% to $8.1 billion, compared with projections for $7.78 billion. The unit picked up market share, Gelsinger said.

A collapse in consumer gadget buying has spread into corporate spending amid concern that the global economy is heading toward a recession. That has confounded predictions by chip-industry leaders that the boom of the past two years could endure, driven by the proliferation of semiconductor use into more types of devices. Computer and smartphone demand remains the primary influence on the fortunes of the broader chip industry, which expanded by more than $100 billion last year and some predicted would rapidly double to become a $1 trillion business.

Many of Intel’s largest rivals have posted downbeat reports or warnings about the outlook for computer components, falling billions short of estimates or slashing their predictions. While periodic slumps are not unusual for the chip business, analysts are concerned that the current decline is driven more by a contraction of the economy than a buildup of excess inventory that would have the potential to clear out quickly.

One bright spot in Gelsinger’s plans to reshape the company came earlier this week, when Intel’s self-driving technology unit, Mobileye Global Inc., began publicly trading in a partial spinoff. Its shares surged 38% in their market debut Wednesday. Intel retains control of the division, which raised $861 million in the share sale. Gelsinger has said Mobileye may serve as a template for other such transactions that will help Intel capitalize on the value of some of its assets.” (2)

Artist Rendering of the Intel Chip Plant to be built in Ohio.

Intel Semiconductor Education and Research Program for Ohio

Intel “[broke] ground in the ‘Silicon Heartland’ on two of the world’s most advanced chip-making facilities. As part of Intel’s commitment to developing a skilled talent pipeline for its two new leading-edge chip fabs, Intel also announced the first phase of funding for its Ohio Semiconductor Education and Research Program. During this first phase, Intel is providing $17.7 million for eight proposals from leading institutions and collaborators in Ohio to develop semiconductor-focused education and workforce programs.

“Today marks a pivotal moment in the journey to build a more geographically balanced and resilient semiconductor supply chain. The establishment of the Silicon Heartland is testament to the power of government incentives to unlock private investment, create thousands of high-paying jobs, and benefit U.S. economic and national security. We would not be here today without the support of leaders in the administration, Congress and the state of Ohio, who share a vision to help restore the United States to its rightful place as a leader in advanced chipmaking.”

Investing to revitalize the U.S. chipmaking ecosystem will bring a broad range of economic benefits while helping to restore balance, dependability, and resilience to the global semiconductor supply chain. In Ohio, Intel’s more than $20 billion planned investment in a new semiconductor manufacturing site to produce leading-edge chips is expected to generate 7,000 construction jobs and 3,000 long-term positions in manufacturing and engineering. In addition to providing capacity for Intel’s next-generation products, the company expects these new factories to support growing demand for the company’s new foundry business, Intel Foundry Services (IFS). Intel’s investment in Ohio builds on the company’s announcement in Arizona to build two new fabs and its expansion in New Mexico to add advanced packaging capabilities.

When combined with Intel’s silicon R&D capabilities, this new site in Licking County, Ohio, will expand the company’s U.S. “lab-to-fab” pipeline. Intel also recently celebrated the grand opening of the latest expansion of its leading-edge developmental factory in Oregon, where engineers advance Moore’s Law by creating new transistor architectures, wafer processes, and packaging technologies that underpin the company’s product roadmap. That investment represents the next phase of Intel’s commitment to driving U.S. leadership in semiconductor research and development. Intel’s Ohio Semiconductor Education and Research Program will fund collaborative proposals led by the University of Cincinnati, Central State University, Columbus State Community College, Kent State University, Lorain County Community College, Ohio University, and two from The Ohio State University. Altogether, these eight proposals involve more than 80 institutions of higher education across Ohio.

The eight leading institutions will receive $17.7 million in funding over three years as part of Intel’s $50 million commitment to Ohio higher education institutions over the next decade. This collaborative program will enable higher education institutions to address semiconductor manufacturing workforce shortages and technical challenges, and to innovate and develop new capabilities with an emphasis on chipmaking. Intel expects this first iteration of the program to produce nearly 9,000 graduates for the industry and provide more than 2,300 scholarships over a three-year period, fostering a diverse homegrown talent pipeline.Intel is committed to expanding digital readiness to reach 30 million people in 30,000 institutions in 30 countries. This education and workforce program is one more step forward in Intel’s 2030 Goals and the company’s dedication to using tech as a force for good, underscoring its aim to make technology fully inclusive and to expand digital readiness worldwide.

In September, The U.S. National Science Foundation and Intel launched the first phase of the $100 million national collaboration over the next 10 years to conduct research and to expand and diversify the workforce. In March, Intel launched the semiconductor manufacturing Quick Start program at Mesa Community College in Arizona. Quick Start is an accelerated two-week program that prepares students for rewarding careers as semiconductor technicians with hands-on learning from experienced Intel employees as instructors. This year, Intel expanded its AI for Workforce program in which Intel collaborates with community colleges to address workforce readiness skills through instruction in artificial intelligence. Currently, there are 70 schools in 32 states participating in the AI Incubator Network, and in July, Intel and others awarded $600,000 to 15 community colleges to build their AI labs.” (4)

Even More Context: Intel Invests in Ohio (Press Kit) | Global Manufacturing at Intel (Press Kit) | Intel’s Relentless Pursuit of Next-Gen Workforce Pipeline | Intel Semiconductor Education and Research Program for Ohio

Source: Intel – Learn About Intel’s Role as a Systems Foundry

The cost-saving efforts by Intel are all in an effort to increase factory efficiency through the restructuring of a portion of the company business model to an “internal foundry model”. A strategic re-alignment to a foundry model mirrors the foundry architecture of the dominant Asian production models like that of Taiwan-based TSMC: “At Intel Innovation, Intel CEO Pat Gelsinger said Intel Foundry Services (IFS) is ushering in the ‘systems foundry era.’ Instead of only supplying wafers to customers, like a traditional foundry, Gelsinger said IFS offers silicon, packaging, software, chiplets, IntelON, and Manufacturing.”

Intel CEO Gelsinger “remains upbeat about the company’s Integrated Device Manufacturing (IDM) 2.0 turnaround plan that tightly ties Intel foundries with integrated circuit design for both Intel and its foundry customers. That model establishes consistent processes, systems, and guardrails among business units, design, and manufacturing teams.

‘We’re staying true to the strategy—making cost adjustments and trying to balance market outlooks as we gain share in some segments and we fight for share in other segments,’ said Gelsinger. ‘I was very pleased with how the team executed in improving our execution in an environment that was really quite tough.'” (3)

“IFS USMAG Alliance combines a trusted design ecosystem with U.S.-based manufacturing to enable assured chip design and production at leading-edge nodes.

What’s New: Intel Foundry Services (IFS) today launched a strategic addition to its design ecosystem Accelerator program. The new USMAG (United States Military, Aerospace and Government) Alliance brings together a trusted design ecosystem with U.S.-based manufacturing to enable assured chip design and production on advanced process technologies and meet the stringent design and production requirements of national security applications. A first in the industry, the program’s initial members include leading companies like Cadence, Synopsys, Siemens Digital Industries Software, Intrinsix and Trusted Semiconductor Solutions.

“Semiconductors enable technologies critical to U.S. national security and economic and global competitiveness. Intel is committed to restoring end-to-end U.S. chipmaking leadership through major investments in both R&D and scale manufacturing here in the United States. As the only U.S.-based foundry with leading-edge process capabilities, IFS is uniquely positioned to lead this effort and galvanize the ecosystem to build a more resilient and secure supply chain for U.S. military, aerospace and government customers.”

–Randhir Thakur, president of Intel Foundry Services

Why It’s Important: National security and government applications focus on securing vital information systems and decision networks, requiring scalable chip design and production capabilities. Leading-edge semiconductors are the bedrock of these systems and networks. In addition to requiring the most advanced process technologies, MAG applications also impose unique functional requirements like radiation hardening by design, wide ambient temperature tolerance and others. Securing these chips requires end-to-end capabilities across the semiconductor design and manufacturing life cycle. A closely coordinated effort between advanced manufacturers and their electronic design automation (EDA), IP and design service alliance members is crucial to deliver the functional and operational security required by MAG applications.

How It Works: Through the USMAG Alliance, IFS will collaborate with members to enable their readiness to support MAG designs on leading-edge technology nodes. The alliance will ensure that EDA members’ tools are optimized to deliver secure design methodologies and flows and enabled to operate in secure design environments, while meeting the requirements of IFS’ process design kits (PDK). IFS will also work with IP-provider members to deliver design IP blocks that serve MAG specifications for quality and reliability. Finally, IFS will enable the members who provide design services to implement USMAG design projects using IFS reference flows and methodologies. The USMAG Alliance will provide an assured and scalable path for customers to deploy designs that fully achieve the unique requirements of MAG applications.

The new USMAG Alliance builds on IFS’ leadership role in the U.S. Department of Defense Rapid Assured Microelectronics Prototypes – Commercial (RAMP-C) program. The RAMP-C program facilitates the use of a U.S.-based commercial semiconductor foundry ecosystem to fabricate the assured leading-edge custom and integrated circuits and commercial products required for critical Department of Defense systems.

About the IFS Accelerator: In February 2022, IFS launched its Accelerator design ecosystem program to help foundry customers bring their silicon products from idea to implementation. Through deep collaboration with industry-leading companies, IFS Accelerator taps the best capabilities available in the industry to help advance customer innovation on Intel’s foundry platform offerings. The IFS Accelerator provides customers a comprehensive suite of tools, including validated EDA solutions, silicon-verified IP and design services that allow customers to focus on creating unique product ideas.” (5)

More Context: Enabling a Trusted Design Ecosystem (Quote Sheet) | IFS Accelerator

Commerce, NIST, and Implementation of the CHIPS and Science Act of 2022: There were many vital takeaways from our recent What’s Next? interview with Dr. Melissa Flagg and Dr. Jennifer Buss on the Chips and Science Act of 2022, but the most crucial insights from Flagg and Buss were about the future role of the Department of Commerce and the NIST (National Institute of Standards and Technology, which is housed at Commerce) in the implementation of the legislation. The implementation of the Chips and Science Act of 202 is, arguably, a marathon not a sprint (although the three to the five-year timeline of the law is structured as a sprint, which is a telling data point in and of itself). We remain bullish on what NIST and Secretary Raimondo are doing some really dynamic things at Commerce, including the national security messaging, the central role of strategic thinking, and the partnerships with the private sector represented by these recent sophisticated reports and announcements. Internally and operationally, Raimondo and her leadership team seem to have already broken the shackles of the short-term, ‘tactical sprint’ time frame of the Chips Act and aligned their strategic thinking and risk awareness to more of a ‘strategic marathon’ timeline, which is encouraging.

Security and Cybersecurity Implications: Look for the Bureau of Industry and Security, also housed with the U.S. Department of Commerce, to have a more clear seat at the table in later stages of the CHIPS Act implementations. Also, the NIST NIST Computer Security Resource Center (CSRC) and Information Security and Privacy Advisory Board are resources that keep showing up in a variety of OODA Loop research contexts, so we have created alerts and/or tracking feeds for their activities as well.

CHIPS.Gov: Commerce recently launched the CHIPS.Gov website – which we encourage our members to use as an ongoing resource for the latest developments on the Chips Act implementation. The chips.gov website leads with a list of “Implementation Priorities”:

“The Department of Commerce will balance urgent needs in the semiconductor industry with long-term strategic goals. The CHIPS program is a marathon, not a sprint. The program includes several tools, some with near-term benefits and many with a longer-term horizon. We encourage participants to view CHIPS as a long-term program and a sustained partnership between the public and private sectors. As we embark on program design, we have set out the following principles:

Scenario Planning for Global Computer Chip Supply Chain Disruption: Results of an OODA Stratigame: This report is the outcome of our first OODA wargame, which we have branded as a Stratigame (Strategic Game), focusing on the global computer chip supply chain issues. Over 25 members of the OODA Network of Experts participated in this Stratigame where the OODA research team developed four scenarios and then led a structured discussion in which experts provided unique insights into potential impacts of these scenarios, adjacent risks and opportunities, and recommended actions that would allow us to avoid the negative impacts of a particular scenario or nudge us into a more favorable scenario.

With the U.S. Delegation in Asia, We Revisit our OODA Stratigame Insights about Taiwan: It may simply be a question of timing, media attention, and the direct involvement of the #2 person in the line of POTUS succession, but the arrival today of a House Speaker Pelosi-led U.S. delegation in Taiwan is stirring global controversy and geopolitical tensions.. Perception and the media cycle do matter in our current information ecosystem. We thought the best version of OODA Loop ‘coverage’ of the trip by Pelosi et. al. is to return to our Fall 2021 Stratigame. Our analysis is neither prescriptive nor predictive but offers a framing of the issues which achieves better and more informed questions and insights about the impact of this geopolitical maelstrom.

U.S. Chip Fabs “Shovel Ready” as Soon as CHIPS and Science Act of 2022 Signed into Law Today: As corruption is sending shock waves through China’s chipmaking industry, President Biden signs the CHIPS and Science Act of 2022 into law in the White House Rose Garden. Following are the fab projects which have been previously announced and will commence groundbreaking activities as soon as the $52 billion semiconductor manufacturing subsidy known as the CHIPS Act is signed into law.

What Next? Dr. Melissa Flagg and Dr. Jennifer Buss on the Chips and Science Act of 2022 (Part 1 of 2): In Part I of this interview, we discuss the real policy, procurement, and contract management implications of the CHIPS Act weeks after its passage into law.

What Next? Dr. Melissa Flagg and Dr. Jennifer Buss on The Chips and Science Act of 2022 (Part 2 of 2): In Part II of the interview, we discuss the operational capabilities required to provide true foundational leadership in the semiconductor industry of the future, the talent pipeline challenge, what we are tracking moving forward, and, finally, with the passage of the CHIPS and Science Act of 2022, what is our strongest scenario planning narrative?

It should go without saying that tracking threats are critical to inform your actions. This includes reading our OODA Daily Pulse, which will give you insights into the nature of the threat and risks to business operations.

Use OODA Loop to improve your decision-making in any competitive endeavor. Explore OODA Loop

The greatest determinant of your success will be the quality of your decisions. We examine frameworks for understanding and reducing risk while enabling opportunities. Topics include Black Swans, Gray Rhinos, Foresight, Strategy, Strategies, Business Intelligence, and Intelligent Enterprises. Leadership in the modern age is also a key topic in this domain. Explore Decision Intelligence

We track the rapidly changing world of technology with a focus on what leaders need to know to improve decision-making. The future of tech is being created now and we provide insights that enable optimized action based on the future of tech. We provide deep insights into Artificial Intelligence, Machine Learning, Cloud Computing, Quantum Computing, Security Technology, and Space Technology. Explore Disruptive/Exponential Tech

Security and resiliency topics include geopolitical and cyber risk, cyber conflict, cyber diplomacy, cybersecurity, nation-state conflict, non-nation state conflict, global health, international crime, supply chain, and terrorism. Explore Security and Resiliency

The OODA community includes a broad group of decision-makers, analysts, entrepreneurs, government leaders, and tech creators. Interact with and learn from your peers via online monthly meetings, OODA Salons, the OODAcast, in-person conferences, and an online forum. For the most sensitive discussions interact with executive leaders via a closed Wickr channel. The community also has access to a member-only video library. Explore The OODA Community.