Featured Image Source: SIA 2022 Annual Report Cover

In March, we extended our tracking of minerals for semiconductor production to the annual Unites States Geological Survey (USGS) 2022 List of Critical Minerals, which includes minerals like Palladium, C4F6, Helium, and Scandium – all of which are used in semiconductor production and or the manufacturing of sensors and memory.

In April, we provided a general update on the global chip supply chain disruption in the context of more esoteric updates like:

- Fake chips as a growing threat to national security and critical systems;

- Neon output for chips cut in half since Russia’s attack on Ukraine; and

- Design concerns shifting towards component sourcing (brought on by component shortages which have created a concern for long-term sourcing, even for prototypes).

We now widen the lens further to garner broad industry insights from the annual Semiconductor Industry Association’s (SIA) 2021 State of the U.S. Semiconductor Industry and SIA 2022 Factbook.

SIA 2021 State of the U.S. Semiconductor Industry – From the Report:

In 2021, semiconductors helped steady a world wobbled by COVID-19, and the industry’s future has never been brighter. As semiconductor innovation and global chip demand continue their inextricable rise, government and industry must work together to maintain America’s leadership in this foundational, indispensable technology.

While the semiconductor industry has achieved great success in 2021, it also faces significant challenges, such as:

- A widespread global semiconductor shortage. Unanticipated rising demand for semiconductors needed during the pandemic response, coupled with significant fluctuations in chip demand for other products such as cars, triggered a rippling supply-demand imbalance felt across the world.

- The semiconductor industry has worked diligently to increase production to address high demand, shipping more semiconductors on a monthly basis than ever before by the middle of 2021, but most industry analysts expect the shortage to linger into 2022.”

- The shortage increased awareness of the importance of America’s semiconductor supply chains. Although geographic specialization in the global chip supply chain has enabled tremendous growth and innovation in the industry, vulnerabilities in the supply chain have emerged in recent years. For example, in 2019, 100% of the world’s most advanced logic semiconductors (< 10 nm) were produced overseas.

- The U.S. government has taken notice of the need to fortify America’s semiconductor supply chains through robust investments in U.S. chip production and innovation. In June 2021, the U.S. Senate passed the United States Innovation and Competition Act (USICA), broad competitiveness legislation that includes $52 billion to bolster domestic chip manufacturing, research, and design. The semiconductor industry has urged the U.S. House of Representatives to follow suit and send legislation to the President’s desk to be signed into law.”

With the 100% production overseas of the most advanced logic semiconductors as the linchpin of concerns over the long-term health of the global chip manufacturing supply chain, especially the world’s dependence on production in Taiwain, it is easy to forget the strong strategic metrics which the SIA report highlights, including:

- Exponential Innovation at Lower Costs: A single smartphone today has far more computing power than the computers used by NASA to land a person on the moon in 1969.

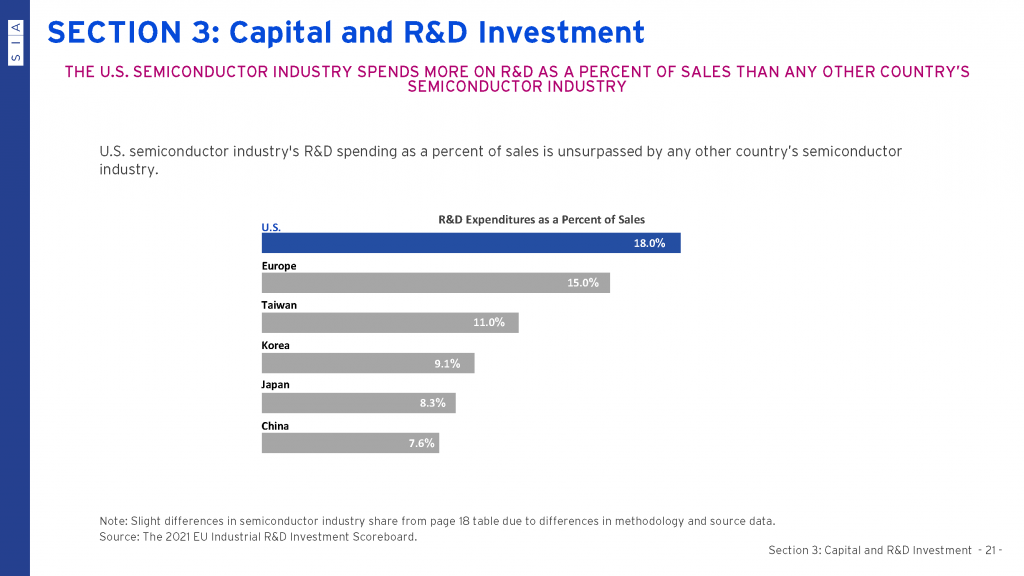

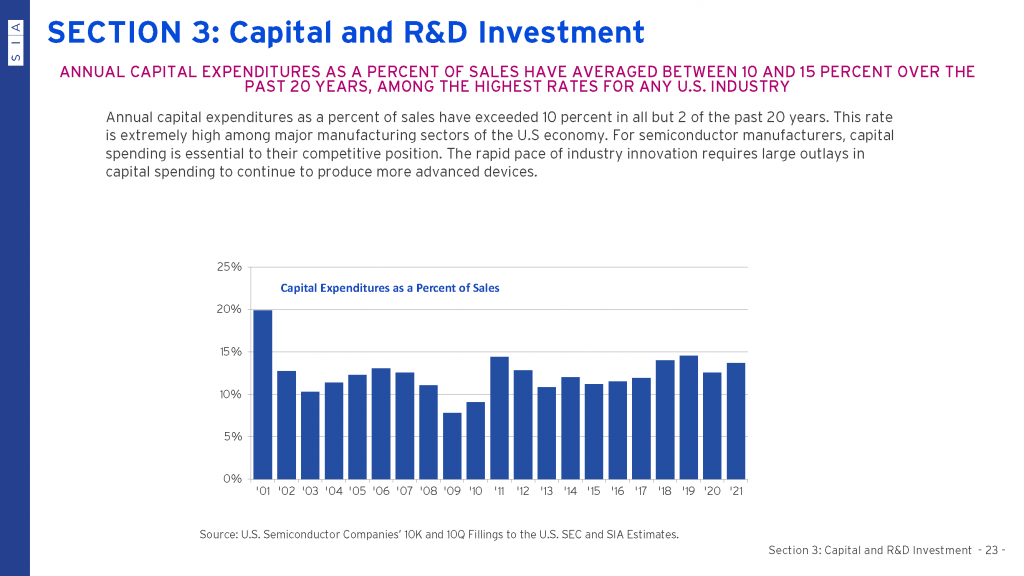

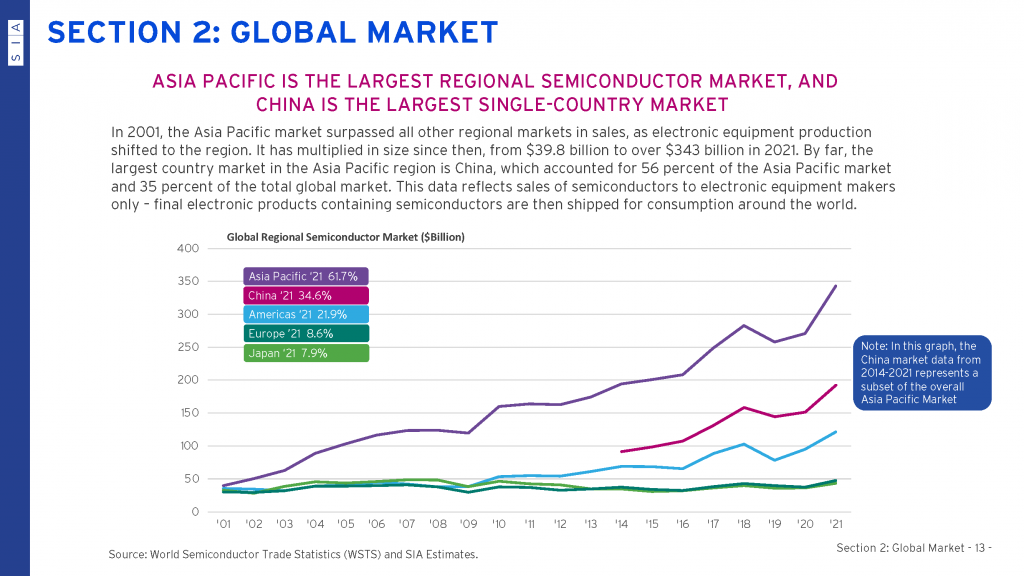

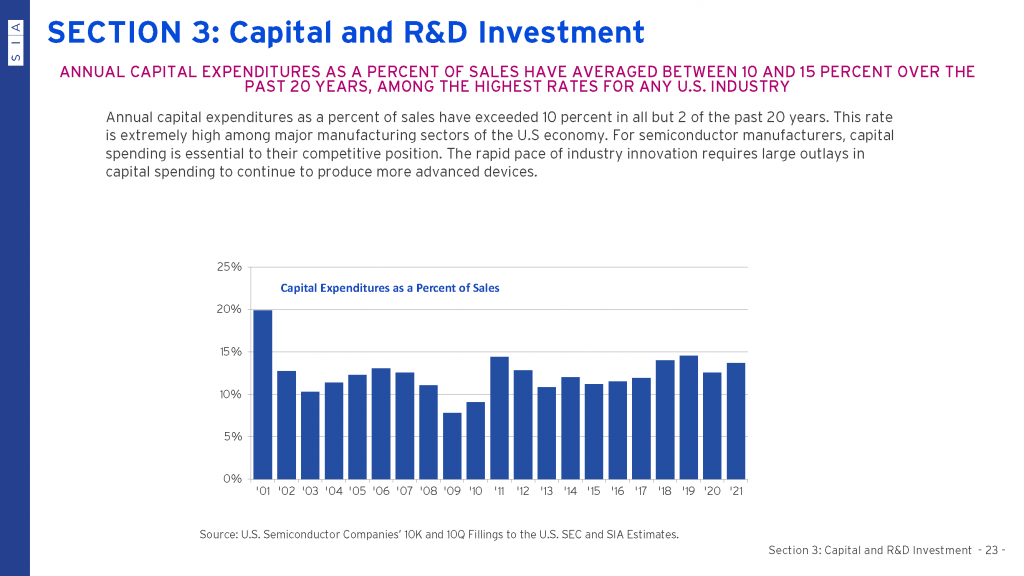

- Commitment to Strategic Research and Development: The industry invests about one-fifth of its annual revenue into ($50 billion in 2021), which is the second-highest share of any major U.S. industry, behind only the pharmaceutical industry.

- #1 Contributor to Labor Productivity Growth: Semiconductor technology has made virtually all sectors of the U.S. economy – from farming to manufacturing – more effective and efficient.

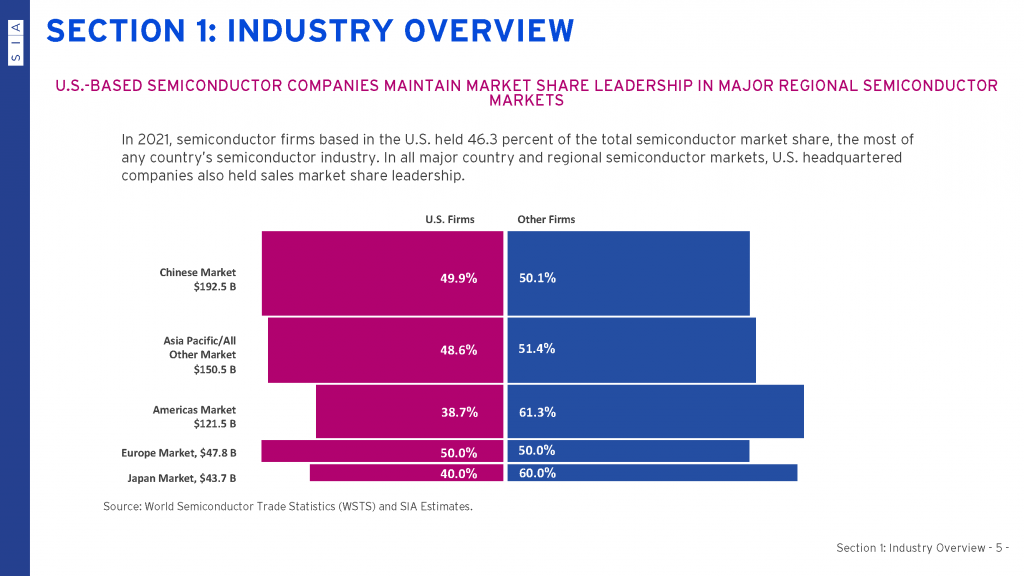

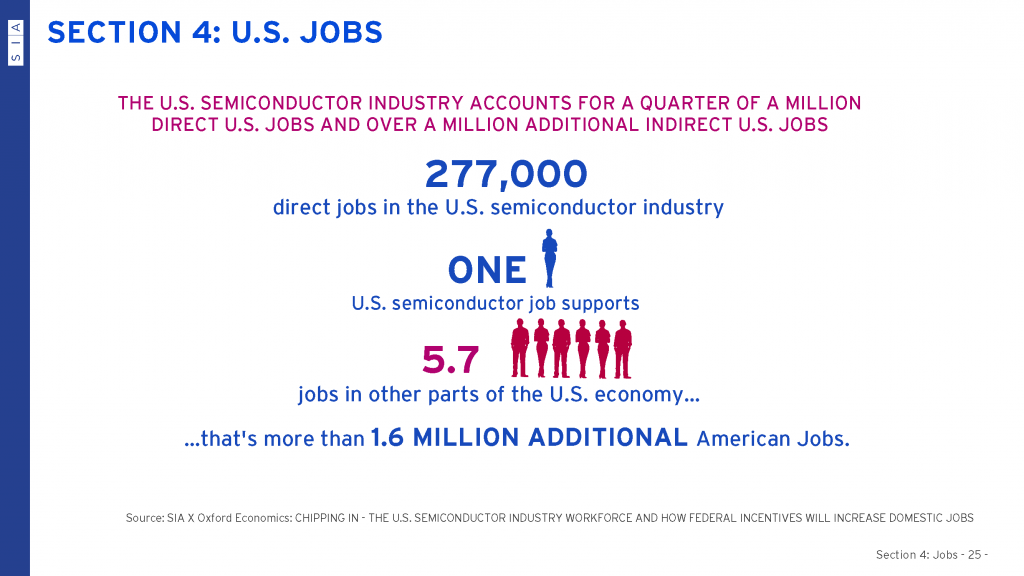

- Global Leadership: The U.S. semiconductor industry makes up about half of the global market share, with sales of $258 billion in 2021.

- Strong Stateside Production: 18 states are home to major semiconductor manufacturing facilities, with close to half of the U.S. semiconductor manufacturing done in the U.S.

- Strong International Sales Mix and Trade Surplus. More than 80% of U.S. semiconductor companies’ sales are to overseas customers. The United States exported $60 billion in semiconductors in 2021 and maintains a consistent trade surplus in semiconductors, including with major trading partners such as China. (1) (2)

Chips Get the World through First Two Years of Pandemic and Beyond

The SIA Report offers an interesting framing of how semiconductors contributed to the lifestyle changes and uncertainty wrought by Covid-19, itemizing “the number of ways semiconductors have proven essential in supporting the world through the pandemic:

- Accelerating Vaccine Development. Accurate and timely testing for COVID-19 was a vital part of assessing risk and determining treatment needs for the public, and semiconductor-enabled medical instruments helped advance testing efforts. Temperature screenings have become common for many workplaces and public facilities hoping to reopen their spaces to large amounts of people. This has been done using thermal cameras or non-contact forehead infrared thermometers that are enabled by semiconductors such as sensors and analog chips that translate real-world phenomena such as temperature into digital readings.

- Medical Devices. Two specific examples of semiconductors in medical devices helping in the COVID-19 fight are 1) Portable Ultrasound Devices. In a hospital setting, the first line of detection for COVID-19 is identifying recognizable symptoms of the virus such as lung lesions. Quickly identifying this trait of the severe acute pneumonia associated with the virus has allowed doctors to treat afflicted patients without having to wait for tests on viral infection. This rapid response is possible with handheld ultrasound devices and temperature screening. These portable ultrasound devices have transitioned from utilizing piezoelectric crystals to semiconductors, greatly reducing the cost and improving performance. Now, due to the utilization of semiconductors, hospitals have access to vastly more affordable and efficient technologies to assess internal injuries in patients; and 2) Ventilators. Ventilators are utilized to treat patients with severe lung damage by assisting breathing and are controlled by semiconductor chips. The ventilator system uses semiconductor sensors and processors to monitor vital signals; determine the rate, volume, and amount of oxygen per breath; and accurately adjust oxygen levels according to the needs of the patient. These signals are read and interpreted by the machine’s semiconductor processors, which control the speed of the motor and translate to mechanized breathing to support a patient.

- Virtual Everything. Semiconductors underpin the IT infrastructure necessary for maintaining communication networks between colleagues and classmates outside of a traditional office and school setting. Firms that could conduct business remotely quickly reacted to the pandemic by shifting resources to digital communication, and the trend may be here to stay. With network usage growing between 30 to 50% for top providers, chip-enabled communication infrastructure has provided a lifeline to businesses and schools to carry on with remote work and school for many throughout the pandemic. Delivery and transportation services are heavily dependent upon rapid communication capabilities. Some examples are the large fleets of truck drivers that operate long shifts and require coordinated support from fleet managers. Both pick-up and delivery options for store items, groceries, and restaurant food have been popular during the pandemic because mobile phone apps have made transactions easy and safe. Grocery delivery companies utilize the ubiquity of smartphones to connect shoppers and customers, and these semiconductor-enabled services have seen a massive increase in application downloads and order quantities.

From the 2022 SIA Factbook

What Next?

To conclude the annual report, the SIA lays out the following innovation policy landscape for the future:

To ensure continued U.S. leadership in the global semiconductor industry, the U.S. must adopt an ambitious competitiveness and innovation agenda. By implementing these policies, Congress and the Administration can take key steps to protect American leadership in semiconductor technology and win the global competition for the technologies of the future:

- Invest in U.S. Semiconductor Leadership

- Fund the domestic semiconductor manufacturing, research, and design provisions in the CHIPS for America Act.

- Enact an investment tax credit encompassing both manufacturing and design to spur the construction of new onshore advanced semiconductor research, design, and manufacturing facilities and to promote domestic chip innovation.

- Strengthen America’s Technology Workforce

- Implement a national strategy — backed by appropriate investments and in consultation with education leaders and the private sector — to improve our education system and increase the number of Americans graduating in STEM fields.

- Reform America’s high-skilled immigration system to enable access to, and retention of, the best and brightest in the world.

- Promote Free Trade and Protect IP

- Approve and modernize free trade agreements that remove market barriers, protect IP and enable fair competition.

- Expand the Information Technology Agreement, one of the World Trade Organization’s most successful free trade agreements.

- Cooperate closely with Like-Minded Economies

- Recognizing the global nature of the semiconductor industry, expand collaboration with like-minded allies on shaping a regulatory and legal environment more conducive to growth, innovation, and supply chain resilience in such areas as regulatory coherence, standards, and export controls.

Report Methodology

The SIA 2021 State of the U.S. Semiconductor Industry report is based on data developed independently by the Semiconductor Industry Association and in conjunction with the Boston Consulting Group and Oxford Economics. Figures pertaining to the industry’s employment are based on data from the U.S. Census Bureau and the U.S. Department of Labor. Figures regarding the industry’s international trade activity are based on an analysis of official U.S. government trade data from the U.S. International Trade Commission. Figures regarding industry manufacturing, capacity, and capital spending were based on data from SEMI, VLSI Research, New York University, McKinsey, The Economist, Tokyo Electron, J.P. Morgan, and IC Insights. Market data was based on World Semiconductor Trade Statistics data. Lastly, industry R&D data was based on company financial reports, as well as data from New York University.

Further Resources

Download the Full Report: 2021-SIA-State-of-the-Industry-Report.pdf;

Also: SIA Factbook 2022

Related Reading:

Explore OODA Research and Analysis

Use OODA Loop to improve your decision-making in any competitive endeavor. Explore OODA Loop

Decision Intelligence

The greatest determinant of your success will be the quality of your decisions. We examine frameworks for understanding and reducing risk while enabling opportunities. Topics include Black Swans, Gray Rhinos, Foresight, Strategy, Stratigames, Business Intelligence, and Intelligent Enterprises. Leadership in the modern age is also a key topic in this domain. Explore Decision Intelligence

Disruptive/Exponential Technology

We track the rapidly changing world of technology with a focus on what leaders need to know to improve decision-making. The future of tech is being created now and we provide insights that enable optimized action based on the future of tech. We provide deep insights into Artificial Intelligence, Machine Learning, Cloud Computing, Quantum Computing, Security Technology, Space Technology. Explore Disruptive/Exponential Tech

Security and Resiliency

Security and resiliency topics include geopolitical and cyber risk, cyber conflict, cyber diplomacy, cybersecurity, nation-state conflict, non-nation state conflict, global health, international crime, supply chain, and terrorism. Explore Security and Resiliency

Community

The OODA community includes a broad group of decision-makers, analysts, entrepreneurs, government leaders, and tech creators. Interact with and learn from your peers via online monthly meetings, OODA Salons, the OODAcast, in-person conferences, and an online forum. For the most sensitive discussions interact with executive leaders via a closed Wickr channel. The community also has access to a member-only video library. Explore The OODA Community

About the Author

Daniel Pereira

Daniel Pereira is research director at OODA. He is a foresight strategist, creative technologist, and an information communication technology (ICT) and digital media researcher with 20+ years of experience directing public/private partnerships and strategic innovation initiatives.

Subscribe to OODA Daily Pulse

The OODA Daily Pulse Report provides a detailed summary of the top cybersecurity, technology, and global risk stories of the day.