Start your day with intelligence. Get The OODA Daily Pulse.

Start your day with intelligence. Get The OODA Daily Pulse.

Global supply chains continue to experience the impact of the late March 2022 Shanghai and Shenzen Covid-19 lockdowns in China, which impacted the port operations of both cities, sending a long-term ripple effect into the global supply chain:

“The disruption in the wake of Shanghai’s shutdown comes shortly after the same thing happened in the port city of Shenzhen. The lockdown posed challenges for all shipping companies as well as congestion and delays at ports due to restrictions and testing requirements. Recent weeks and the Shenzhen shutdown have created turmoil in the shipping and logistics industry, where fears of new Covid-related restrictions at Chinese ports have shot down hopes of an early normalization in the container market somewhat…logistics company DSV’s chief executive, Jens Bjørn Andersen, has expressed concern that new Chinese closures will delay normalization of the pressured freight market until sometime in 2023.” (1)

The central role of Shenzhen’s manufacturing and logistics operations in the global supply is important to understand:

“When disruptions take place in China, it is significant because about a third of the world’s entire manufacturing capacity is based in the country. If you’re buying something online there’s a very good chance it was made in Shenzhen – a city of 17.5 million in the southeast where roughly half of all China’s online retail exporters are based. So, when Shenzhen went into a six-day lockdown…after a massive surge in Covid cases, it sent shockwaves through the world’s businesses. The restrictions have since widened to other major cities and provinces like Shanghai, Jilin, and Guangzhou. Factories had to suspend production, and cities turned into ghost towns. The number of ships waiting at some Chinese ports has already increased, according to project44 which monitors how freight is moving across the world. ‘We saw a 28.5% increase in the number of vessels waiting outside of the port of Yantian which is a major export port to Europe and North America,’ says Adam Compain, senior vice president of project44.” (2)

Meanwhile, the current threat to the global supply chain is another typhoon, Typhoon Muifa, the 2nd in the last ten days:

“Another typhoon has prompted the ports of Shanghai and Ningbo to close for the second time in 10 days, with forwarders expecting a ‘ripple effect’ of shipping delays.

Although weaker than Typhoon Hinnamor – which saw Shanghai, Ningbo, and Busan all suspend operations last week – Typhoon Muifa is on a direct path to hit Shanghai tomorrow, according to the US Joint Typhoon Warning Center.

Norman Global Logistics (NGL) told customers Shanghai’s Yangshan container terminals were due to stop gate-in handling by 7 pm local time today, while both Waigaoqiao and Yangshan terminals would be fully closed by 8 am tomorrow morning.

Ningbo’s container terminals and yards were already closed this morning, NGL said. A spokeswoman for Dimerco said Muifa was due to pass Shanghai in ‘no more than a day’ but added that inland trucking would be ‘dangerous’ during the typhoon’s impact.'” (3)

Future Typhoons. Future Covid-19 Lockdowns. Future Pandemics. Future Climate Crises Impacts. Future Wars. All of it adds up to a clear incentive structure for American businesses to reshore manufacturing and shorten supply chains. OODA CTO Bob Gourley spelled it all out in a post earlier this year:

“Reshoring is the transfer of business operations back to their country of origin. The term is usually associated with manufacturing but it applies to any business operation.

The trend of reshoring back to the US from China began about a decade ago when some businesses realized costs in China (including labor and compliance and also transportation) were rising. Meanwhile, automation was changing the cost equation for some business operations, making reshoring decisions easier. Over the last decade, tariffs due to unfair practices and persecution of ethnic minorities added new motivation to reshore. The pandemic and China’s zero covid policy and resulting shutdowns of industry and transportation in China have now built an even stronger motivation to reshore, and the war in Ukraine has proven to doubters the importance of having supply chains free of the influence of totalitarian nations. The trend of reshoring will clearly accelerate.”

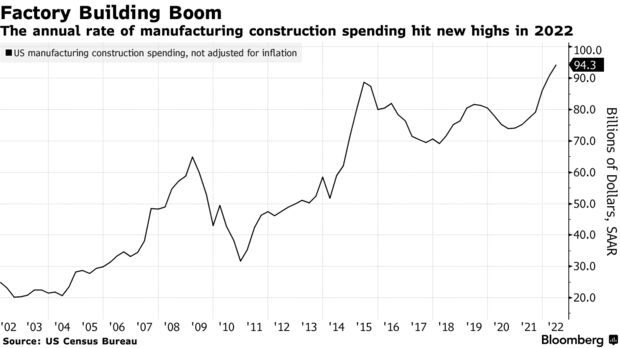

Bob’s insights have proven remarkably prescient, as reshoring is proving not to be a passing trend for American companies, but potentially a long-term strategic realignment of the U.S. manufacturing base:

“There has been a sense in financial circles that the fever among American executives to shorten supply lines and bring production back home would prove short-lived. As soon as the pandemic started to fade, so too would the fad, the thinking went.

And yet, two years in, not only is the trend still alive, it appears to be rapidly accelerating.

Rattled by the most recent wave of strict Covid lockdowns in China, the long-time manufacturing hub of choice for multinationals, CEOs have been highlighting plans to relocate production — using the buzzwords onshoring, restoring, or nearshoring — at a greater clip this year than they even did in the first six months of the pandemic, according to a review of earnings call and conference presentations transcribed by Bloomberg. (Compared to pre-pandemic periods, these references are up over 1,000%.)” (4)

Following are some of the signals from the market on this reshoring activity in the U.S.:

The case study of Generac Holdings is also instructional, as it includes a company’s reaction to the impact of the Trump Administration’s China tariff, well before the impact of the Covid 19 pandemic, and the strategic response by the company to the war in Ukraine as well (both of which have impacted global trade in addition to the drivers discussed so far):

“Generac Holdings, a maker of power generators, started mapping out plans to shift some production from China, and when the pandemic hit, those plans got supercharged. The company now gets more of its parts from suppliers in the US and Mexico, produces more generators near its headquarters outside Milwaukee and runs a brand new plant in a small town just north of Augusta, Georgia.

‘We wanted to be closer to our customers in the southeast,’ said Chief Operations Officer Tom Pettit. Low shipping costs and quick delivery times are proving a hit with clients and paving the way for the company to keep growing, he said. Opened just a year ago, expansion work on the plant is already underway.

Russia’s invasion of Ukraine also got Pettit’s attention.

Not just because the war further snarled global trade and added to the surge in freight costs but because it reminded him that China could try something similar in Taiwan. And in the same way that business ended for most Western companies in Russia, so too it could end in China. Suddenly, that benign geopolitical backdrop that had helped encourage so many executives to globalize their operations over the past few decades was vanishing. And this, Pettit said, added to his sense of urgency to change things up.

‘President Xi Jinping has not been shy about wanting to reunify China and Taiwan,’ Pettit said. ‘We still think China is incredibly competitive. However, we need to have dual sources outside of China.'” (4)

Reshoring manufacturing and rethinking supply chains will be discussed (when we gather as the OODA Community in October at OODAcon 2022 – The Future of Exponential Innovation & Disruption) in the context of the panel Tomorrowland: A Global Threat Brief, with:

Bob Gourley, CTO of OODA LLC | Former CTO at Defense Intelligence Agency

Johnny Sawyer, Founder of the Sawyer Group | Former Chief of Staff at Defense Intelligence Agency

A description of the panel: The Pandemic, Russian invasion of Ukraine, demographic inversions, and technological labor force disruption have combined to forever shift the global geo-strategic environment. This session will examine the new world economy, seeking actionable insights for practitioners who need a deeper understanding of new realities. Impacts on individuals, investors, businesses, the military, and governments will be examined.

Bob Gourley’s aforementioned post Reshoring Will Accelerate: Businesses should fully assess supply chains first.

To register for OODAcon, go to: OODAcon 2022 – The Future of Exponential Innovation & Disruption

It should go without saying that tracking threats are critical to inform your actions. This includes reading our OODA Daily Pulse, which will give you insights into the nature of the threat and risks to business operations.

Use OODA Loop to improve your decision-making in any competitive endeavor. Explore OODA Loop

The greatest determinant of your success will be the quality of your decisions. We examine frameworks for understanding and reducing risk while enabling opportunities. Topics include Black Swans, Gray Rhinos, Foresight, Strategy, Strategies, Business Intelligence, and Intelligent Enterprises. Leadership in the modern age is also a key topic in this domain. Explore Decision Intelligence

We track the rapidly changing world of technology with a focus on what leaders need to know to improve decision-making. The future of tech is being created now and we provide insights that enable optimized action based on the future of tech. We provide deep insights into Artificial Intelligence, Machine Learning, Cloud Computing, Quantum Computing, Security Technology, and Space Technology. Explore Disruptive/Exponential Tech

Security and resiliency topics include geopolitical and cyber risk, cyber conflict, cyber diplomacy, cybersecurity, nation-state conflict, non-nation state conflict, global health, international crime, supply chain, and terrorism. Explore Security and Resiliency

The OODA community includes a broad group of decision-makers, analysts, entrepreneurs, government leaders, and tech creators. Interact with and learn from your peers via online monthly meetings, OODA Salons, the OODAcast, in-person conferences, and an online forum. For the most sensitive discussions interact with executive leaders via a closed Wickr channel. The community also has access to a member-only video library. Explore The OODA Community.